nys workers comp taxes

You can get a paper form from your employer or from the NYS Workers Compensation Board. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness.

Workers Compensation Insurance Overview Amtrust Financial

Learn about employer coverage requirements for workers compensation disability and Paid Family Leave as well as your rights and responsibilities in the claim process.

. So in most cases you dont have to worry. Workers compensation benefits for work injuries are tax-exempt if they are paid under the workers compensation act and also includes the survivors that receive benefits for fatal injuries. If you withhold New York State New York City or Yonkers income tax from your employees wages you must report it quarterly on Form NYS-45.

Do you claim workers comp on taxes the answer is no. Every domestic foreign or alien insurance corporation taxable under Article 33 that does business employs capital owns or leases property or maintains an office in the Metropolitan Commuter Transportation District includes the counties of New York Bronx Queens Kings Richmond Dutchess Nassau Orange Putnam Rockland Suffolk and Westchester shall. In a workers compensation case no one party is determined to be at fault.

Also under IRS regulations non-taxable workers compensation-related benefits are not eligible for salary deferral under the New York State Deferred Compensation Plan NYSDCP. For a complete list visit the New York Civil Practice Law and Rules CPLR Article 52. Pay unemployment insurance contributions.

You retire due to your occupational sickness. Although payments were sent with state taxes already taken out they may still be subject to federal income tax. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel.

Payments from the Excluded Workers Fund are considered taxable income. If you withhold less than 700 during a calendar quarter pay the tax with your Form NYS-45. Forms will be mailed to the address provided in the EWF program application.

The quick answer is that generally workers compensation benefits are not taxable. In most cases they wont pay taxes on workers comp benefits. The Department of Labor will mail 1099-G tax forms to all EWF recipients in late January.

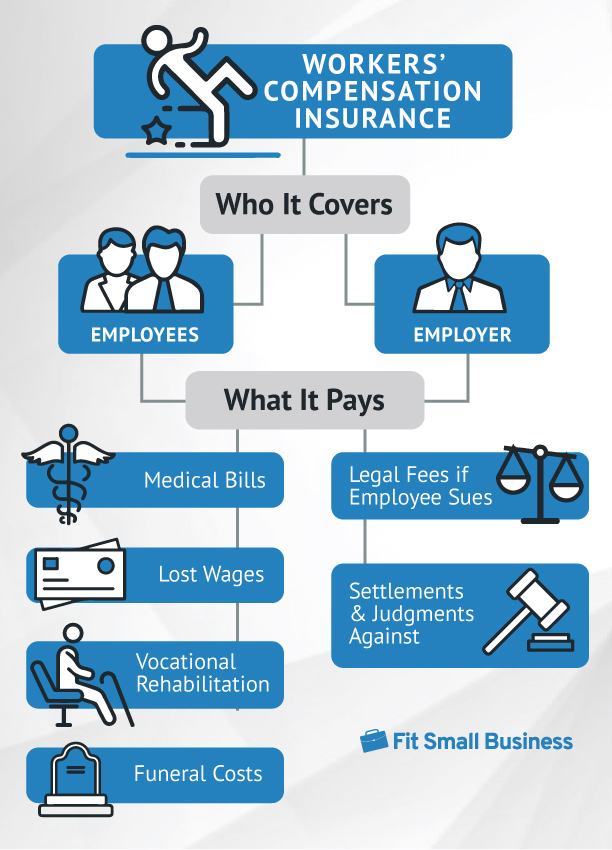

Unemployment disability or workers compensation benefits. It protects employers from liability for on-the-job injury or illness and provides the following. Workers comp benefits are non-taxable insurance settlements.

Workers compensation benefits are not considered taxable income at the federal state and local levels. Workers compensation insurance is mandatory for most employers of one or more employees. Publication NYS-50 Employers Guide to Unemployment Insurance Wage Reporting and.

Filing requirements NYS-45 NYS-1 Filing methods. Pay the metropolitan commuter transportation mobility tax MCTMT Resources. The money you receive from your compensation claim is not taxable on either the state or federal level whether you receive monthly payments or obtained a lump sum settlement.

Be sure to enter your taxpayer ID when prompted. To resolve a levy you will need to call us at 518-457-5893 during regular business hours and speak with a representative. If Board intervention is necessary it will determine whether that insurer will reimburse for cash benefits andor medical care and the amounts payable.

The Workers Compensation Board is a state agency that processes the claims. Legal representation for the employer by the insurance carrier. The Advocate for Business offers educational presentations on topics important to business such as an employers responsibilities and insurance requirements as well as reducing premiums and penalties.

A 1099-G tax form provides the total amount of money you were paid in benefits from NYS DOL as well as any adjustments or tax withholding made to your benefits. A Board representative will take your information and complete the C-3 form. Your treating health care provider must be authorized by the Workers Compensation Board WCB except in an emergency situation.

You are responsible to pay the amount you withhold to the Tax Department as follows. However retirement plan benefits are taxable if either of these apply. Get information about the benefits available under workers compensation including medical care lost wages and benefits for survivors.

The Employer Compensation Expense Program ECEP established an optional Employer Compensation Expense Tax ECET that employers can elect each year to pay if they have employees that earn over 40000 annually in wages and compensation in New York State. Submit a paper C-3 form. Protection for the employer against most lawsuits for on-the-job injuriesillnesses.

Information for Employers regarding Workers Compensation Coverage. Workers compensation-related benefits are also exempt from New York State and local income taxes if applicable. While a worker does need to report these benefits on New York tax form W-2 Wage and Tax Statements the amount awarded by the New York State Workers Compensation Board is excluded from.

Get information on medical benefits and help finding a provider. The amount that a claimant receives. EWF benefits are considered taxable income and may be subjected to federal income tax.

Employers may also be required to. File a C-3 employee claim. The short answer to whether or not workers compensation benefits are taxable is quite simply no.

Public or private pensions. To find an authorized provider visit the WCB website at wwwwcbnygov or call 1-877-632-4996. Typically in New York workers that receive benefits from workers compensation due to an on the job injury are not subjected to taxes at the federal state or local levels.

Remember all medical bills relating to your on-the-job injury are the responsibility of your workers compensation.

What Wages Are Subject To Workers Comp Hourly Inc

Ny Workers Compensation C 3 Form Injury Attorney

Understanding Your Workers Comp Ex Mod Factor Payroll Medics Payroll Workers Compensation Hr Solutions

Workers Comp Is Never Off The Clock

Workers Compensation Insurance Costs Vary By State And Depend On A Variety Of Factor Workers Compensation Insurance Compare Insurance Small Business Insurance

Are My Workers Comp Benefits Taxable In Massachusetts

Workers Compensation Benefits How Much Does Workers Comp Pay

The Ultimate Guide To Workers Compensation Laws In New York

Is Workers Compensation Taxable In North Carolina Riddle Brantley

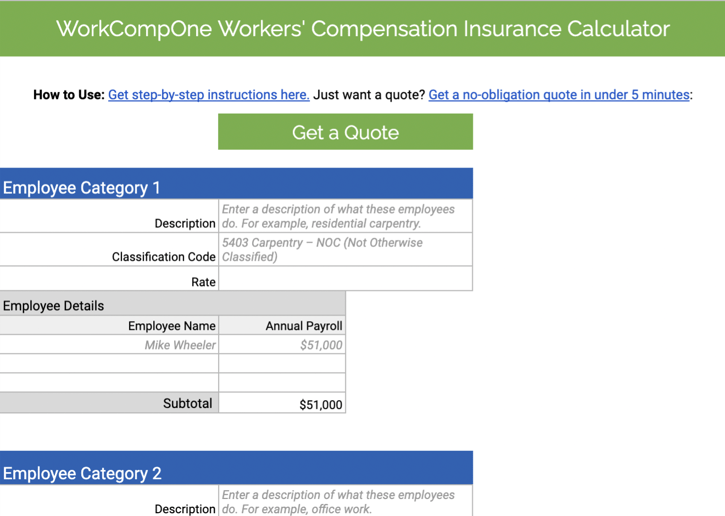

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

States With The Highest Per Employee Workers Comp Costs Propertycasualty360

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

Is Workers Comp Taxable Workers Comp Taxes

Ny Workers Comp Max Settlement Amounts Paul Giannetti Attorney At Law

Workers Compensation Insurance Workmans Comp Insurance Quotes